aurora sales tax rate 2021

This is the total of state county and city sales tax rates. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

Aurora Cannabis Announces Fiscal 2021 Fourth Quarter Results

The minimum combined 2022 sales tax rate for Aurora Minnesota is.

. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Aurora-RTD 290 100 010 025 375. The current total local sales tax rate in Aurora CO is 8000.

COLUMBUS OH 43216-0530. The Aurora sales tax rate is. The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities.

For tax rates in other cities see Maine sales taxes by city and county. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The sales tax jurisdiction name is Maine which may refer to a local government division.

You can print a 55 sales tax table here. The minimum combined 2022 sales tax rate for aurora colorado is 8. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The average sales tax rate in Colorado is 6078. The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

You can print a 85 sales tax table here. Informational Bulletin - Sales Tax Rate Change Summary FY 2022-08 2 Sales Tax Rate Changes for Sales of General Merchandise Jurisdiction Combined rate ending December 31 2021 Rate Change NEW Combined rate beginning January 1 2022 Type of Local Tax Change Municipalities Addison 800 025 825 Home Rule Arcola Downtown and I-57 Business District. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This is the total of state county and city sales tax rates. The Aurora Sales Tax is collected by the merchant on all qualifying sales. Year Municipal Rate Educational Rate Final Tax Rate.

For unincorporated areas in Cook County the ST-1ST-2 combined rate is. DEPARTMENT OF TAXATION. The december 2020 total local sales tax rate was also 8000.

Find your Illinois combined state and local tax rate. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Sales Tax Rate as of July 1 2021 Counties Municipalities Cook County imposes a 175 county home rule sales tax.

The average sales tax rate in Arkansas is 8551. Aurora DuPage 125 Aurora Kane 125 Aurora Kendall 125. Illinois sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The minimum combined 2022 sales tax rate for Aurora Colorado is 8. 4 Sales tax on food liquor for immediate consumption. Residential Property Tax Rate for Aurora from 2018 to 2021.

With CD 290 000 010 025 375. STATE OF OHIO. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The Colorado sales tax rate is currently 29. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. Method to calculate Huerfano County sales tax in 2021.

The 55 sales tax rate in Aurora consists of 55 Maine state sales tax. 5 Food for home consumption. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Method to calculate Austin sales tax in 2021. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

For tax rates in other cities see Colorado sales taxes by city and county. This is the total of state county and city sales tax rates. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County.

The December 2020 total local sales tax rate was also 8000. Up the specific sales tax rate for an individual address. The Minnesota sales tax rate is currently.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. There is no applicable county tax city tax or special tax.

Sales tax rates for arapahoe county. The County sales tax rate is 025. The base state sales tax rate in Illinois is 625.

The County sales tax rate is. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

Local tax rates in Illinois range from 0 to 475 making the sales tax range in Illinois 625 to 11. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Did South Dakota v.

3 Cap of 200 per month on service fee. PAGE 1 REVISED January 1 2021. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

The Aurora sales tax rate is 375. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. The sales tax rate in aurora is 881 and consists of 29 colorado state sales tax.

The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. What is the sales tax rate in Aurora Colorado. Aurora 12-0003 Northglenn 12-0054 Aurora CD Only 12-0062 Thornton 12-0044 Bennett 12-0007 Unincorporated RTD and CD 12-0206.

Colorado Sales Tax Rates By City County 2022

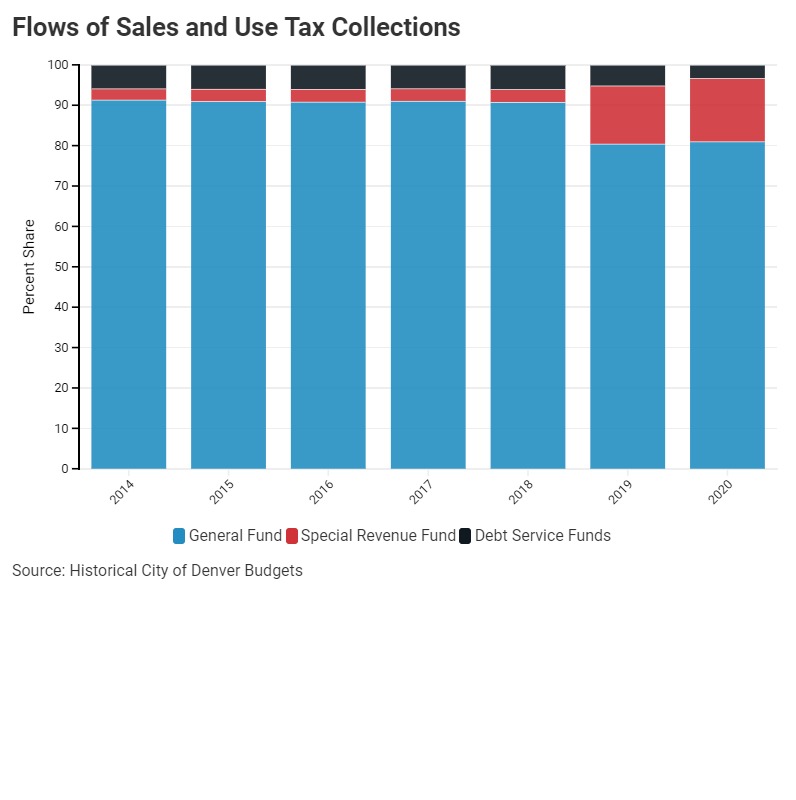

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

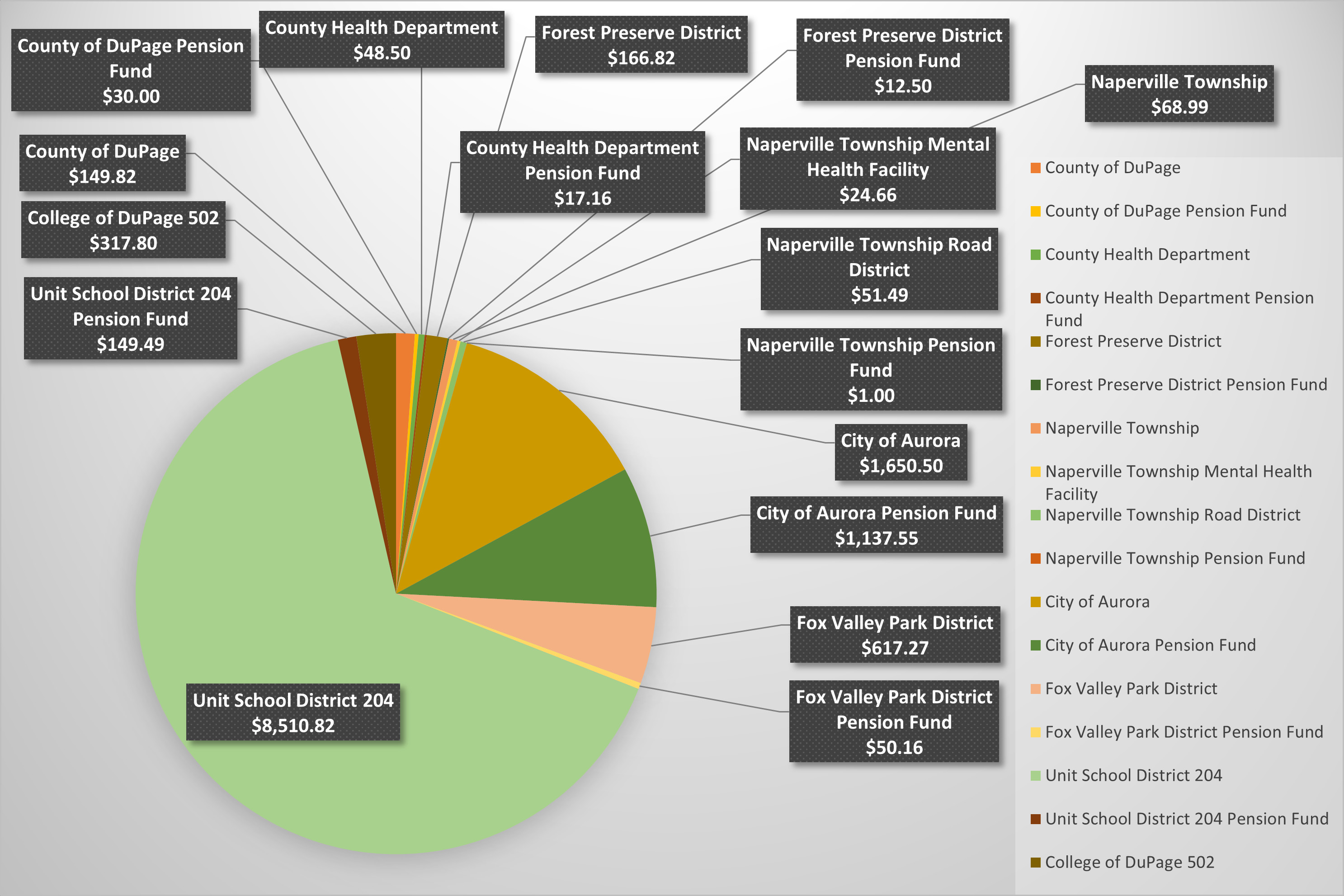

Where Do Property Taxes Go Assessor Naperville Township

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

How Colorado Taxes Work Auto Dealers Dealr Tax

Aurora 6th Highest Taxed Illinois Municipality In 2021 Kane County Reporter

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

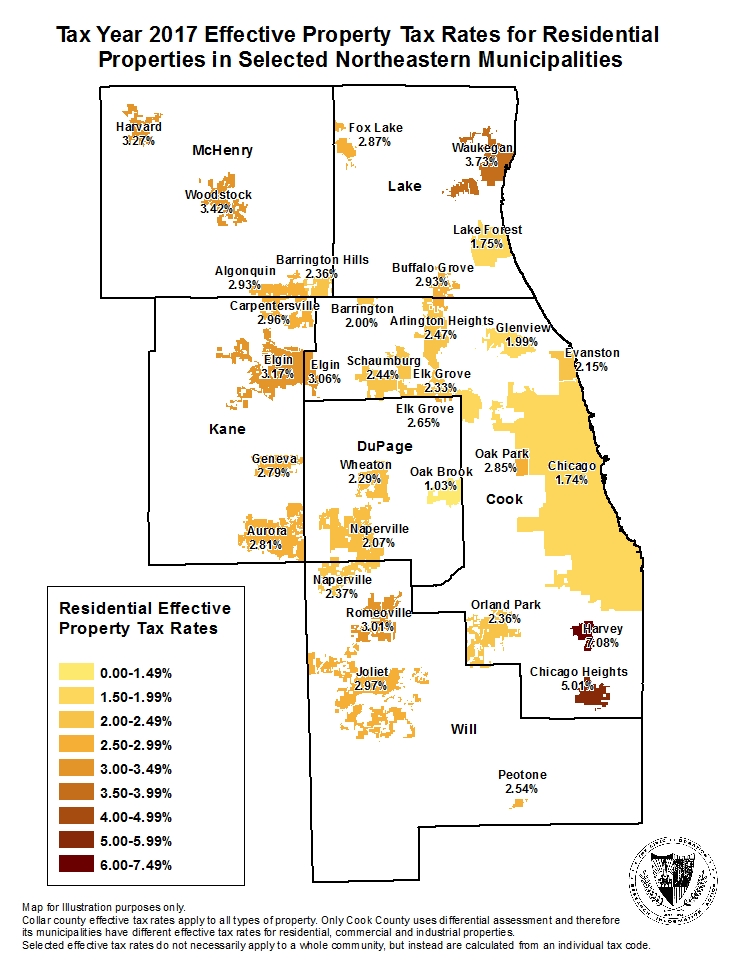

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

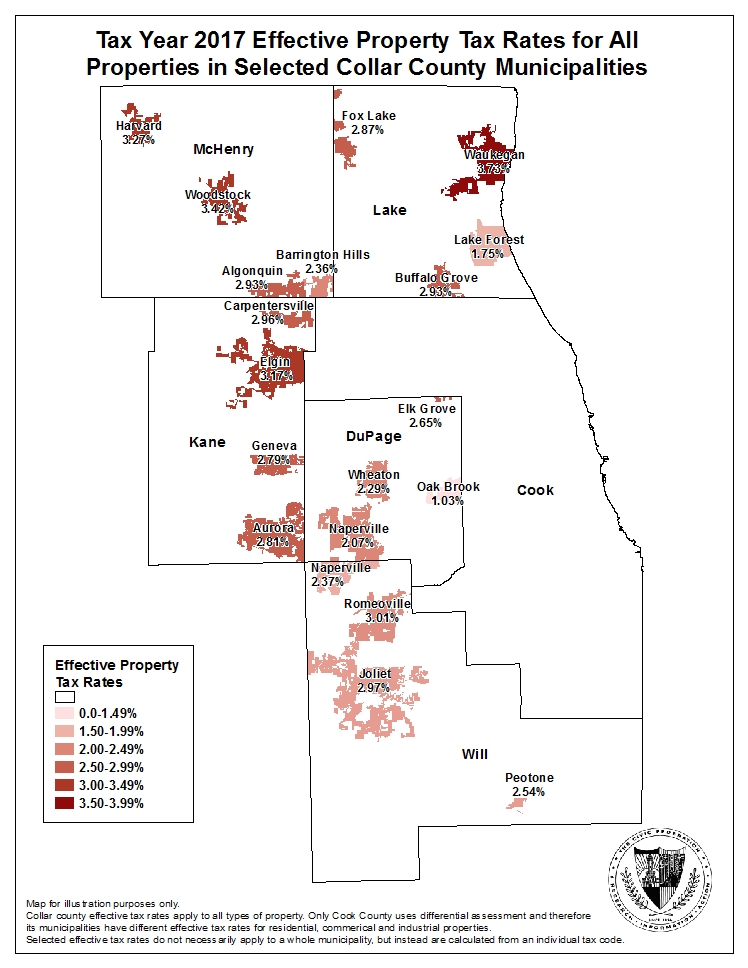

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Cannabis Canada Weekly Aurora Ceo On Focus On Medical Sales Illicit Products Full Of Contaminants Bnn Bloomberg

Property Tax Village Of Carol Stream Il

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation